MEDISEP Scheme Online Registration @ medisep.kerala.gov.in | MEDISEP Application Form 2023 | Download Medisep Card | MEDISEP Hospital List

Government employees and retirees have long been in need of a comprehensive health insurance programme. During the second year of the initial Pinarayi Vijayan ministry, the process got underway. In the second term of the second Pinarayi Vijayan Ministry, the government employee and pensioner health insurance programme has grown to become possibly the largest health insurance programme in the nation. The article will provide you with more details about the Kerala MEDISEP Scheme 2023.

Kerala MEDISEP Scheme 2023

Medical Insurance for State Employees and Pensioners, or MEDISEP as it is more commonly known, is the name given to the programme. On July 1, Chief Minister Pinarayi Vijayan will introduce MEDISEP. Under this program, health insurance will be provided to government employees and pensioners. This 3 Year program will benefit the 30 lakh people of the state. To get the benefits of this scheme, applicants need to register through the official website

Medisep ID Card Download

MEDISEP Scheme Highlights

| Name of the scheme | MEDISEP Scheme Kerala |

| Launched by | Chief Minister Pinarayi Vijayan |

| Year | 2023 |

| State | Kerela |

| Beneficiaries | Pensioners & Employees |

| Official Website | medisep.kerala.gov.in |

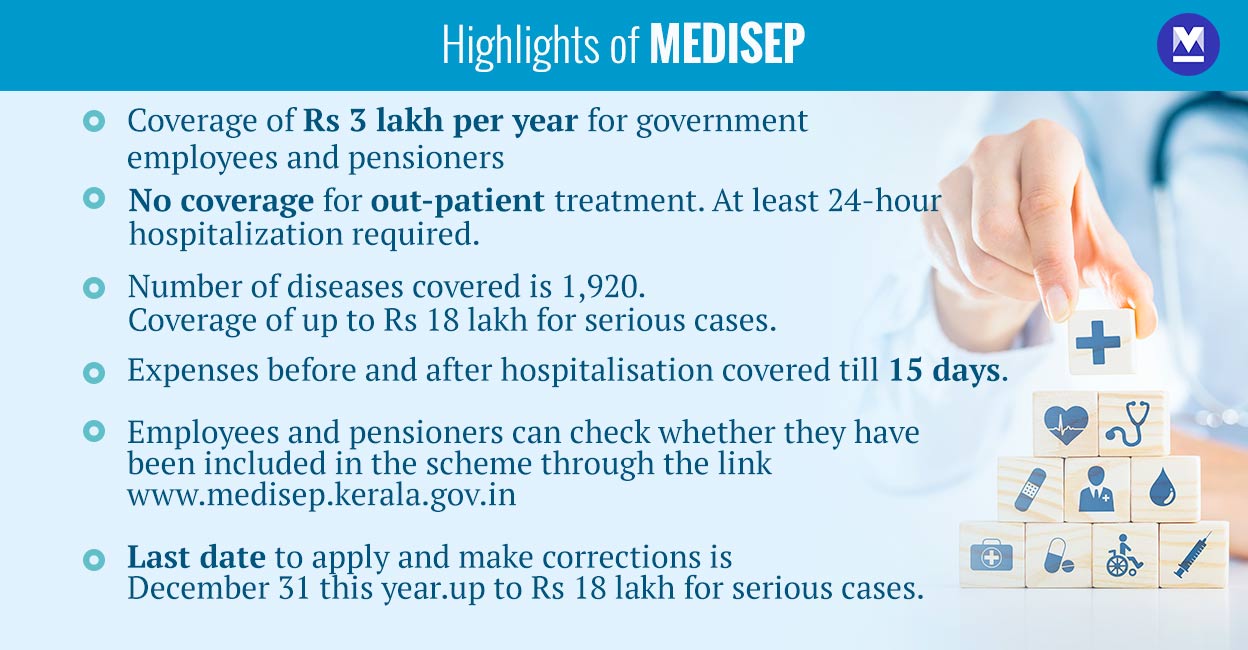

Benefits of MEDISEP Scheme Kerala

The following are the benefits of the MEDISEP Scheme Kerala:

- 30 lakh people will profit from the three-year programme.

- For a premium of Rs 500 per month, it offers a basic plan and an extra package for “catastrophic” illnesses.

- Under the Basic Benefit Package (BBP), MEDISEP will cover eligible expenses incurred by the beneficiary for the mentioned procedures up to Rs 3 lakh per year for three years. The programme will cover a total of 1920 medical procedures and surgical operations.

- The cost of medications, treatments, doctor and attendant fees, hotel charges, diagnostic expenses, implant charges, and meal charges incurred at hospitals with accreditation are all covered by the BBP.

- General Surgery receives the most BBP therapy packages, totalling 197. Surgical oncology contains 156 packages, and cardiology has 168. Orthopaedics has 144, whereas dental surgery has 147. Plastic surgery has 111.

Karunya Arogya Suraksha Padhathi

MEDISEP Scheme Eligibility Criteria

In order to qualify for the MEDISEP KeralaScheme, certain criteria need to be followed which is mentioned below:

- To qualify, the beneficiary must have spent at least 24 hours in the hospital.

Amount Guaranteed by BBP

- A 3-lakh rupee annual coverage would be provided to the beneficiary. Even then, a “floater” mechanism built into MEDISEP allows for an increase of coverage of even Rs 6 lakh.

- A total of Rs 3 lakh is available, of which Rs 1.5 lakh is fixed in nature and the remaining Rs 1.5 lakh is available on a yearly basis known as a “floater basis.”

- Consequently, the first, fixed component of Rs. 1.5 lakh will expire at the end of each year. If the floater component is not used up in the year, it can be carried over to the policy’s following years.

- This means that the beneficiary will receive an insurance cushion of Rs. 4.5 lakh if the floater component is not used in the first year and rolls over into the next one. If the floater component is still unutilized, it will continue to swell, providing the beneficiary with a cushion of Rs. 6 lakh in the third year.

Samagra Kerala

Cashless Facility and Other Benefits in MEDISEP Scheme

- For the operations outlined, MEDISEP will offer a cashless facility and cover any pre-existing conditions. Only hospitals that have been granted empanelled status under the programme are eligible for coverage.

- However, coverage will be offered even if done in hospitals that are not panelled in the case of accidents or other medical emergencies covered by the authorised list of treatments and procedures.

- However, it won’t be cashless in these circumstances. Based on the authorised rates/package of the scheme, the recipient will be compensated for the cost of the treatment.

- The programme will also cover expenses for the 15 days prior to the hospitalisation (the pre-hospitalization period) and the 15 days after the hospitalisation (the post-hospitalization phase).

- An insured mother’s newborns, including twins, are covered from the moment they are born until the end of the current policy plan period. All congenital conditions affecting newborns will be covered under the programme as well.

- The BBP will also cover “Unspecified Procedures,” however the insurance coverage will only be for up to Rs 1.5 lakh. According to the regulatory guidelines published from time to time by the Insurance Regulatory and Development Authority of India (IRDAI), new disorders like COVID-19 will also be covered.

Rates for the Basic Benefit Package Under MEDISEP Scheme

- The treatment cost, implant cost, if any, and room charges are the three costs that make up the BBP package.

- Procedure costs – This will include all costs associated with receiving medical advice and treatment, such as pre-hospitalization costs, medications and consumables, diagnostic and laboratory tests, procedures, including any necessary surgeries, doctor and nursing fees, discharge medications, and, if necessary, post-hospitalization reviews.

- Implants – The cost of the implants will be determined by the National Pharmaceutical Authority of India’s maximum ceiling price (NPPA).

- General ward rooms cost up to Rs. 1000; semi-private rooms cost up to Rs. 1500; and private rooms cost up to Rs. Any fee above the specified ceiling rates would be the patient’s responsibility to pay.

Income Certificate Kerala

Expensive Processes under BBP

- The most expensive treatments covered by the BBP are those in cardio surgery, with most of them having ceiling rates between one lakh and two lakh rupees.

- Aortic Stenting (Single), the most expensive surgery covered by the BBP, has an approved charge of Rs 5.78 lakh, which is more than what insurance will pay for it. The additional expense will be borne by the patient. The only operation in BBP that costs more than three lakh maximum insurance coverage is this one.

- Beneficiaries will be able to afford even this expense due to the floater component. In the third year, the patient will receive total insurance of Rs 6 lakh if Rs 1.5 lakh is not spent for two years in succession.

- The cap for the in-demand procedure intracranial balloon angioplasty with stenting is Rs 2.03 lakh.

Catastrophic Package Costing

- The catastrophic package’s pricing includes four costs: procedure charges, implant costs, room charges and investigation costs.

- Every package will have a single package charge, and the beneficiary will be responsible for any additional costs beyond the ceiling prices.

- For liver transplants, for example, the cap price is Rs 18 lakh. The cost of a kidney transplant is Rs 3 lakh. It is 20 lakh for heart-lung transplants. It costs Rs. 6.39 lakh for a cochlear implant. It costs Rs. 4 lakh to replace the hip completely. Additionally, it costs Rs. 18.24 lakh to implant an auditory brainstem.

- However, the package will also include coverage for any related medical or surgical consequences, and empanelled hospitals have been instructed not to charge the beneficiary for the additional costs.

- A corpus fund of at least Rs 35 crore has been set aside by the insurance business solely for catastrophic illnesses.

Contribution to the Benefit

- Throughout the three years of the scheme, Rs 500 will be taken out of each employee’s income as well as the monthly gross pension entitlement. Therefore, each beneficiary will pay Rs 6000 per year in contributions.

- The government would only yearly pay Rs 4800 (plus GST) per beneficiary to the Oriental Insurance Company Limited, which has been given the contract to administer MEDISEP, even though Rs 6000 will be taken from the beneficiaries.

- If the insurance provider finds that the Rs 35 crore it had set aside for catastrophic illness is insufficient, it will use the additional money it has received from the beneficiary.

Kerala Labour Registration

Who will be Benefitted?

The plan aims to provide complete health insurance coverage to all State government employees currently employed—nearly five lakh people—who are currently covered under the Kerala Government Servants Medical Attendant (KGSMA) Rules, 1960, as well as roughly an equal number of retired people (5 lakh).

Teaching and non-teaching staff at aided schools and colleges are considered service workers. The direct hired personal staff of the Chief Minister, ministers, Leader of the Opposition and Chief Whip, Speaker, Deputy Speaker, and the Chairmen of the Financial Committees have also been included as beneficiaries. Additionally, employees of the universities that receive grant-in-aid from the State Government and Local Self Government Institutions have also been included as beneficiaries.

As they are likewise covered by the KGSMA Rules, even the staff members of the High Court of Kerala are included.

The teaching and non-teaching staff of aided schools and colleges as well as pensioners from universities that receive grants from the State Government and LSGIs are all considered pensioners. Additionally benefited are the family and personal staff pensioners who were hired directly.

Additionally, part-time contingent workers, part-time instructors, teaching and non-teaching personnel of aided schools and colleges and their families, as well as retirees and their spouses and children pensioners, will all be required to participate in the programme.

All of the aforementioned categories will be required to enrol in the programme. However, participation in the programme is optional for civil service employees working for the Keralan government.

The total number of people who would get benefits under MEDISEP would exceed 30 lakh when recipients and their dependents are taken into account.

Who are the dependents?

Partner. parents who depend on the beneficiary completely. Children.

Children will only be counted as the beneficiary’s dependents if both parents are beneficiaries.

Who won’t be Benefitted?

The employees and pensioners of autonomous bodies, cooperative institutions, and boards, such as KSRTC, KSEB, and Kerala Water Authority, will not be eligible. The State Information Commission and the Human Rights Commission’s staff members and retirees were also excluded.

Kerala Ration Card

What if a Worker Chooses not to?

If a worker chooses to leave her position during the policy’s term, she may disregard the remaining premium if no claims were made while she was employed. However, if BBP claims were made, she would be required to pay the premium for the whole year or years that she had been a beneficiary; however, if she had been kicked out in the first year, she would only be had to pay the annual premium of Rs 6000. Regardless of the years, she was a beneficiary, if she had received the “extra benefit package” for catastrophic illnesses, she would have been required to pay Rs 18,000, the whole premium for the three-year insurance period.

What Happens if a Worker is put on Leave?

The premium for the time period will be subtracted from the suspended employee’s subsistence allowance if they are an employee who is currently on suspension.

What if a Worker uses LWA?

The option to pay the premium in advance is available to those who choose leave without pay (LWA) for a brief length of time during the policy period that does not exceed one year. If this is not done, the full amount of the premium arrears will be taken out of the first wage received after returning to duty in a lump sum.

Kerala MEDISEP Scheme Registration

To register for the MEDISEP Scheme, the applicant has to follow the simple process given here.

- First of all, open the official website of the MEDISEP Scheme

- The homepage of the website will appear on the screen.

- Now from the homepage, go to the registration option.

- A new page will appear.

- Enter the details in the application form.

- Upload the relevant documents to be uploaded.

- Check the details carefully and click on the submit option.

- In this way, you can easily register for the scheme.

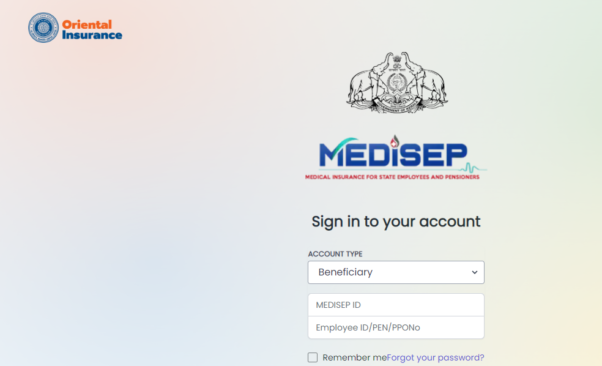

MEDISEP Login Process

- First of all, open the official website of the MEDISEP Scheme

- The homepage of the website will appear on the screen.

- Now from the homepage, go to the login option.

- A new login form will appear on the screen.

- Enter the login details like username and password.

- After that, click on the login option.

- You will be logged in successfully.

Track Application Status Under MEDISEP Scheme

- First of all, open the official website of the MEDISEP Scheme

- The homepage of the website will appear on the screen.

- Now from the homepage, go to the Status option.

- A new page will appear on the screen.

- Now enter the Emp ID/PEN/PPONO, date of birth, and select the category.

- After that, click on the Search option.

- The application status will appear on the screen.

- Click on the Print option to get it downloaded.

Download Medcard

- First of all, open the official website of the MEDISEP Scheme

- The homepage of the website will appear on the screen.

- Now from the homepage, go to the Download Medcard option.

- A new login page will appear on the screen.

- Select the account type and enter the medisep id.

- Now after successful login, you have to click on the download medcard option.

- The card will be downloaded.

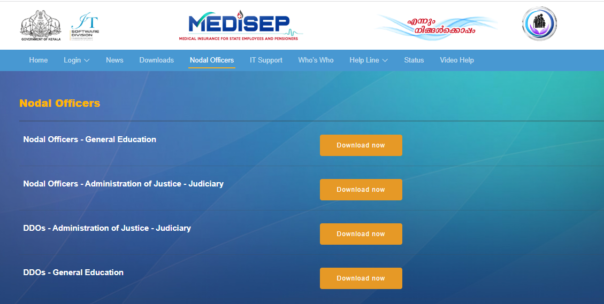

View Nodal Officer Details

- First of all, open the official website of the MEDISEP Scheme

- The homepage of the website will appear on the screen.

- Now from the homepage, go to the Nodal Officers option.

- A new page will appear on the screen.

- The page will have details of all the nodal officers in various files.

- You can click on any of the files and get them downloaded to your device.

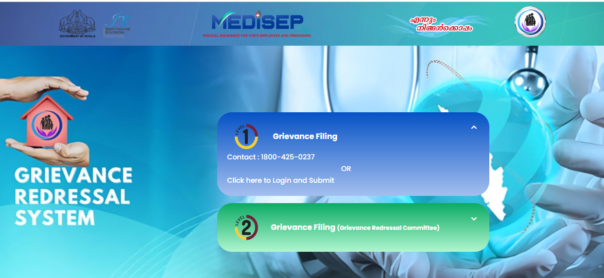

Submit Grievance Under MEDISEP Scheme

- First of all, open the official website of the MEDISEP Scheme

- The homepage of the website will appear on the screen.

- Now from the homepage, go to the Grievance option.

- A new page will appear on the screen.

- Select the Grievance Filing option and then Click here to Login and Submit option.

- A new login form will appear on the screen.

- Select the account type and enter the medisep id.

- After that, click on the sign in option.

- Now you can easily register your complaint here.

MEDISEP Scheme Helpline Number

- Toll Free Number: 1800 – 425 – 1857 Time: (10.15 AM to 5.15 PM)