LTC Cash Voucher Scheme Registration | LTC Cash Voucher Scheme Implementation Process, Benefits & Objective | Insurance Premium In LTC Cash Voucher

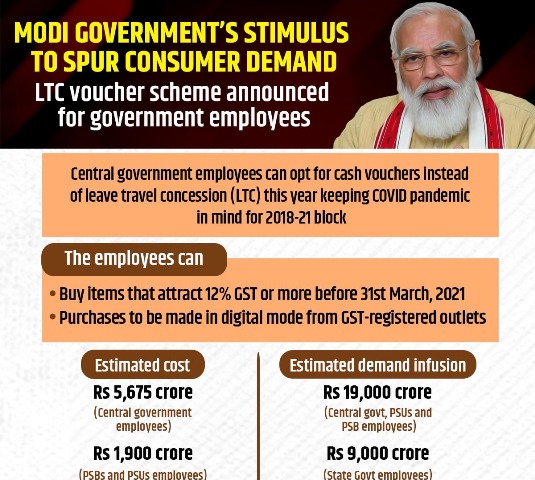

The Finance Minister of our country is launching yet another scheme to benefit all of the Central Government and the State Government employees of our country. The scheme is known as the LTC Cash Voucher Scheme for the year 2021. we will share with all of you the details about the opportunity so that you can apply for it without any problem and interrogation. we will share with all of you the objectives and all of the other procedures related to the LTC cash voucher scheme for the year 2020. We will also share with you all the step by step procedure which we need to follow to apply for the new opportunity launched by the finance minister of the country.

Table of Contents

LTC Cash Voucher Scheme 2021

Through the implementation of the LTC Cash Voucher for the year 2021, the government will be giving cash vouchers to the employees of the central government and also the state government. These vouchers will be provided to the employees so that they can encash them and purchase different types of items as specified by the concerned authorities who have launched the scheme. The employees will be able to purchase the items having the GST amount of around 12%. The employees can only buy the products which are non-food items. The purchases which employees are making by using this cash voucher will only be done through the digital mode off from GST registered outlets.

Insurance Premium In LTC Cash Voucher Scheme

As you all know that on October 12, 2020, the government has announced the LTC Cash Voucher Scheme. Under this scheme, the beneficiaries are required to purchase goods and services that have 12% or more GST in order to avail the benefits. The government had decided to relax the cash encashment condition under this scheme. Now the central government employees can pay an insurance premium of policy purchased between 12th October 2020 to 31st March 2021 and avail the benefits of this scheme.

- This would provide benefits to the Employees as the employee could avail tax benefits and the premium paid will also be reimbursed by the government.

- LTC cash voucher scheme has been launched in order to boost consumer demand.

- The ministry has also made it clear that on purchase of goods like cars, employees are required to submit a self-attested photocopy of bills instead of original bills in order to avail the benefit.

- Under this scheme, an employee can avail the cash package without opting for leave encashment. The government has made leave encashment optional.

All those employees who are due to superannuate before 31 March 2020 are required to submit and settle their vouchers and bills before the superannuation date in order to get benefits under the LTC cash voucher scheme. If any employee opts for only deemed LTC fare without leave encashment and spends three times less of deemed fare then the reimbursement will be on Pro-rata basis. It has to be noted that payment of premium of policies that are purchased before 12th October 2020 aur not covered under this scheme.

| Name | LTC Cash Voucher Scheme 2021 |

| Launched by | Finance minister Nirmala sitharaman |

| Objective | Providing cash vouchers for travelling and buying items |

| Beneficiary | Central Government employees |

| Official site | – |

LTC Cash Voucher Scheme New Update

Previously exemption in Income tax under LTC Cash Voucher Scheme is available only for the Central Government employees. On 29th October 2020, the income tax department had extended the income tax exemption for non-Central Government employees also. So that the consumer can spend money which will ultimately increase the demand in the market. The non-Central Government employees include the employees of State Government, public sector enterprise, bank and private sector.

Objective Of The Scheme

As per the concerned authorities of the government, it is said that this scheme has been launched by the Finance Minister because originally the money must be used by the Government employees on their leaves which were skipped because of the coronavirus pandemic. Now when the travel restrictions are day by day declining the concerned authorities of government will be providing cash vouchers to all of the employees as a travel expense. The employees can travel to any of their destinations by using these cash vouchers but the cash vouchers must be used before the expiration date of 31st March 2021. The employees can travel to their home place or to any other destination. They can cover up the travel expenses by these vouchers.

Special Festival Advance Scheme

Benefits Of LTC Cash Voucher Scheme

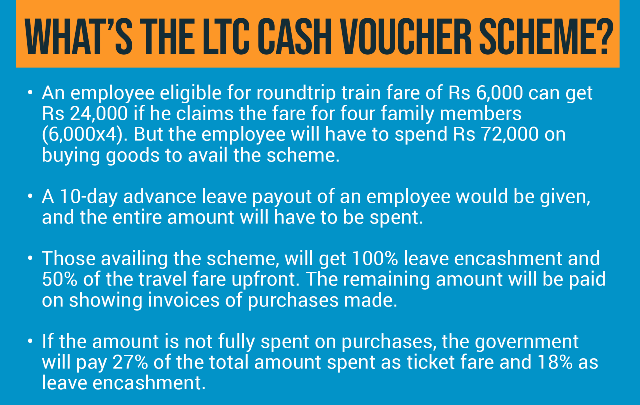

The main aim of the government by launching the LTC Voucher Scheme is to give proper facilities to all of the Central Government employees but also this scheme will help in the economical flow of the country. The employees will be given the travel expense but they still need to spend three times the travel expense voucher that they are provided by the concerned authorities of the finance minister of the country. The employees if given 6000 LTC fare travel voucher then they need to spend 18000 rupees on the non-food items under 12% GST. This will help in the economical flow of the country and also the people will be helping in generating more cash in the economy.

Eligibility Criteria

Applicant must follow the following eligibility criteria while applying for the scheme:-

- The applicant must be a resident of India

- An applicant must be a working Central Government employee

- The applicant can also be a state government employee

Features Of LTC Cash Voucher Scheme

- LTC cash voucher Scheme has launched in order to increase consumer demand in the market

- This scheme is going to increase the economic flow of the country

- Under this scheme, the employee requires to spend three times the travel expense voucher in order to get the benefits

- This amount has to spend on those goods and services that have at least 12% or more GST

- GST invoice has to be produced in order to get the benefits of LTC cash scheme

- The employees are required to purchase from the GST registered outlet through digital mode

- Employees cannot avail the benefit of this scheme if they are purchasing food-related items

- The entitled fare will be provided by the government which the employees need to spend before 31st March 2021

- Public sector and private sector employees can avail the benefit of the scheme

- It will increase the GST collection

- Through LTC cash scheme the government is expecting to create additional demand of Rs 1 lakh crore in the economy

Deemed LTC Fare

The number of LTC vouchers that the employees will get plus the value of these vouchers are as follow:-

| Employees | Vouchers Value |

| Employees who are entitled to business class of airfare | Rupees 36000 |

| Employees who are entitled to an economy class of airfare | Rupees 20000 |

| Employees who are entitled to Rail fare of any class | Rupees 6000 |

LTC Cash Voucher Scheme Registration

There is no additional information regarding LTC Cash Voucher Scheme Registration is available now. We will update here each information as soon as the central government will announce it.