A new scheme will provide beneficiaries with subsidies of up to 25% of project costs. The UYEGP Scheme is a scheme only for the citizens of Tamil Naidu of the MSME department. Tamilnadu UYEGP Scheme attempts to reduce unemployment among the economically and socially disadvantaged. It’s created for educated jobless people to become self-employed in their local locations to reduce rural-to-urban migration due to unemployment. These teenagers are financed to start manufacturing, service, and business firms. In today’s post, we will discuss the motivation for the introduction of the Unemployed Youth Employment Generation Programme. Additionally, its features and advantages, as well as the application process.

Table of Contents

UYEGP Scheme 2022

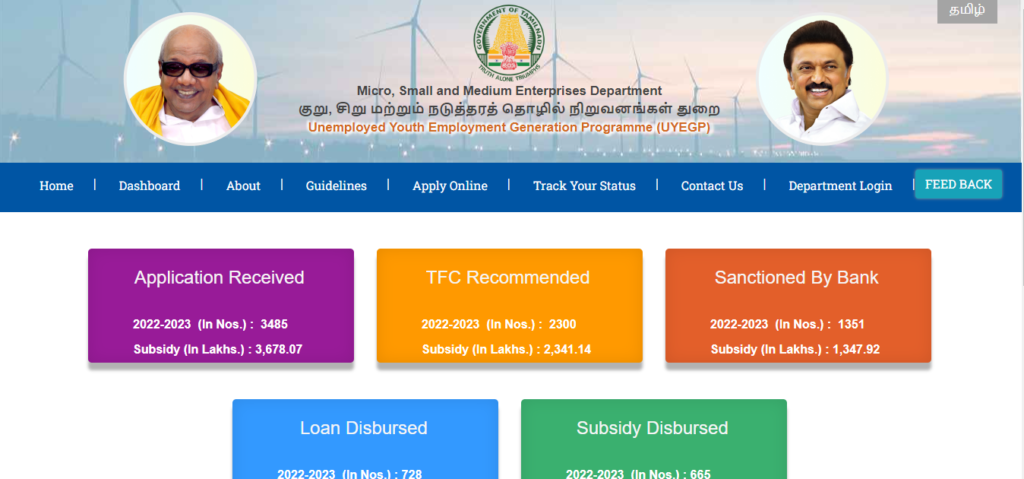

The Government of Tamil Nadu, Department of Micro, Small, and Medium Enterprises, has launched the Unemployed Youth Employment Generation Programme (UYEGP). In addition to overcoming several other business hurdles, an entrepreneur must get urgent financing to launch a new firm. There are or might be circumstances in which banks won’t help them for the first time, whatever the reasons may be. The government of Tamil Nadu has implemented a credit program for small enterprises in order to remedy this issue. UYEGP Scheme is a program designed to inspire unemployed young people to create their own companies and foster youth entrepreneurship.

The state government has taken up concerns to help, but in order to achieve their aim, they have put down some constraints as well, such as age, educational qualifications, and family income, that must be met before applying under the scheme. This program will only make loans up to 90-95% of the project’s cost, with a 25% subsidy available to eligible beneficiaries. The good news is that no assets or guarantees are needed from the applicant. Support with loans through commercial banks will be given. Overall, promoters’ contributions will be no more than 10% of the given scheme, and the rest of the parties involved in the scheme will help newbies to start a business.

Tamil Nadu Naan Mudhalvan Scheme

TN Unemployed Youth Employment Generation Programme Overview

| Scheme Name | UYEGP Scheme 2022 |

| launch year | 2022 |

| Launch by | The Tamil Nadu State Government |

| Beneficiaries | citizens of the state and who have been citizens for the last 3 years. |

| Objectives | provide loans and subsidies for businesses to low-income citizens. |

| Subsidy | 25% of the total Project |

| Website | www.msmeonline.tn.gov.in |

UYEGP Scheme 2022 Objectives

The primary objective of this UYEGP scheme is to reduce unemployment among socially and economically disadvantaged sections of the population, particularly among the educated and unemployed, by enabling them to become self-employed by establishing service, manufacturing, and business enterprises with the aid of a loan and subsidy from the state government. Serving all poor sections of the state means the government is trying to make a better life for citizens of minority groups.

TN Credit Guarantee Scheme

UYEGP Scheme 2022 Benefits & Features

- Sponsorship contribution of 10% for general and 5% for special category schemes to mitigate the unemployment difficulties of economically and socially disadvantaged segments of the population.

- Construction, Commerce, and Service projects: Individual-Based Capital Subsidy @ 25% of the Project Cost Maximum Project Costs of Rs. 15,00,000, Rs. 50,000, and Rs. 500,000 Individual-Based Capital Subsidy @ 25% of the Project Cost (Maximum Rs. 2.50 lakh)

- The interest rate given under the UYEGP plan is in accordance with RBI guidelines for district-level selection of beneficiaries to enable more participation from each district.

- Courses in the Entrepreneur Development Programme (EDP) for seven days for the scheme’s recipients.

- Utilize a variety of financial organizations for the loan, including nationalized banks, private banks, and Tamil Nadu Industrial Cooperative Bank.

- Marketing assistance from the District Industries Center (DIC) also organizes buyer-seller meetings at regular intervals.

- The program prioritizes district-level beneficiary selection to guarantee an equitable distribution of benefits across all districts.

- All recipients are required to participate in a seven-day Entrepreneur Development Programme training course.

- Wide network of banks and financial institutions to provide instant access to cash, including nationalized banks, private banks, and the Tamil Nadu Industrial Cooperative Bank.

- CGTMSE provides loans up to Rs. 10 lakhs without requiring collateral or security from the borrower.

- The General Manager of the related District Industries Center would schedule frequent buyer-seller meetings to give marketing assistance.

Tnvelaivaaippu Online Registration

UYEGP Scheme 2022 Eligibility

Eligible points are as follows:

- The entrepreneur should have an eighth-grade education.

- Any adult (18+) can apply for UYEGP. Special categories have age limits of 35, and general categories have 45-year age limits.

- The couple’s annual income shouldn’t exceed Rs. 1,50,000.

- The entrepreneur must have a 3-year residence.

- Training is required for a UYEGP loan.

- The recipient must not have received a State/Central Government loan or subsidy to apply for UYEGP.

- Applicants must have passed the 8th grade.

- A resident of Tamil Naidu for the last 3 years.

- Applicants must not have taken any kind of loan before.

Unemployed Youth Employment Generation Programme Documents

The documents for the UYEGP scheme are listed below:

- ID Proof

- A quote for the necessary resources included in the project.

- Educational qualification certificate.

- Project report

- Residential proof

- Caste certificate (If applicable)

- Handicapped (If applicable)

- Images that are passport size

- Mobile Number

Tnreginet Registration

UYEGP Scheme 2022 Application Process

The application procedure must be followed as shown in order to apply for the scheme:

- Visit the official website and a homepage will be displayed.

- Choose the UYEGP option from the MSME home page.

- The link will take you to a different page.

- On this new page, click the link that says “Apply Online” then click “New Application” The Unemployed Youth Employment Generation Programme application form will be shown.

- The applicant has to give basic information about the entrepreneur, as well as his or her email address and educational background. Enter them correctly.

- Then upload scanned photos that are the exact size asked for by the website.

- You need to give information about the Line of Activity, the Category of the Venture, the Address where the Activities will Start, and the Project Outlay.

- After you fill out the information, you can look at the list of documents that need to be uploaded.

- Click on the button that says “Proceed” to move the application forward. When you send in your application, you’ll get an application ID.

- Then under “Apply Online” in the Micro, Small, and Medium Enterprises Department, choose “Upload Documents.”

- Give the application ID and click the “Submit” button. You can send all of the files.

- Click “Submit” and your form is submitted. Now authorities will check, verify, and inform you further.

- If accepted, you will get a call for an interview. If the applicant does well in the interview, the bank will be told that the loan should be approved.

- The loan will be approved by the bank. The person who wants to go to the EDP training will get a letter asking them to come.

- You need to send in your certificate of EDP training. The affidavit should be typed on an Rs.20/- Non Judicial Stamp Paper and signed by a Notary Public. The affidavit should be given to the bank along with a copy of the rental or lease agreement when the loan is approved.

- Then you will receive an EDP letter for training, and you have to attend those training sessions. Afterward, you will get a certificate of training as well.

- Then submit the certification to the bank, and loans will be distributed.