e-RUPI Benefits | e RUPI Features & Working Process | Download E-RUPI Mobile Application |

The honorable Prime Minister of India Mr. Narendra Modi has launched digital initiatives from time to time. Over the last few years, a kind of digital revolution has happened in India. The citizens have become more aware of the digital modes of payments which have improved the standard of living. Today through this article we are going to tell you about the e-RUPI Digital Payment platform. This platform is an instrument through which its users can make digital payments. By reading this article you will get to know complete details of this payment mechanism like its objective, benefits, working, download procedure, etc. So if you want to get complete details regarding the e-RUPI digital payment platform then you have to go through this article very carefully till the end.

Table of Contents

What is e-RUPI?

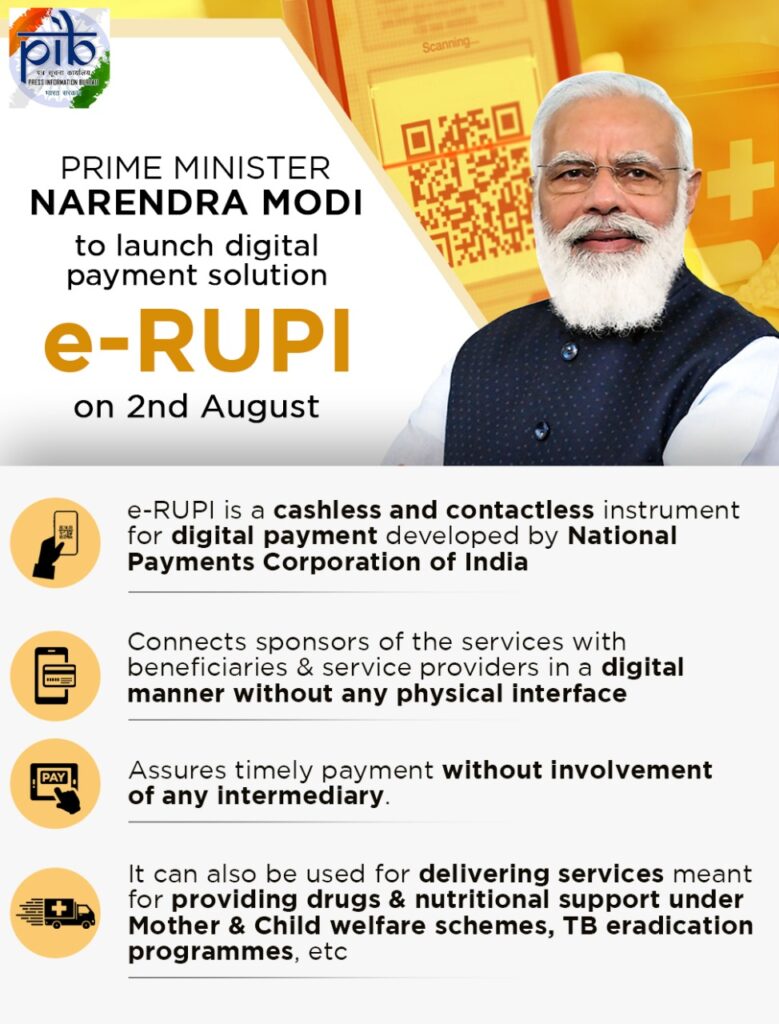

On 2 August, the Prime Minister of India Mr. Narendra Modi is going to launch a digital payment platform called e-RUPI Digital Platform. This platform is a cashless and contactless instrument that will be used for making digital payments. It is a QR code or SMS string-based e-voucher which will be delivered to the mobile of the users. The users will be able to redeem this voucher without any digital payment app, internet banking, or card. This digital payment platform has been developed by the national payments corporation of India on its UPI platform. The collaborating partners are the Department of Financial Services, the Ministry of health and family welfare, and the national health authority. This initiative will connect the sponsor of services with the beneficiaries and service providers. The connection will hold in a digital manner without any kind of physical interface.

Limit Of e-RUPI Voucher Enhanced

The Central Bank of India has raised the limit of e-RUPI Digital vouchers that are issued by the government, in order to pave the way to transfer more benefits to the public. The Reserve Bank of India is going to increase the maximum limit of e-RUPI vouchers from Rs 10000 to Rs 1 lakh. Multiple uses of single vouchers can also be done till the balance is exhausted. Earlier e-RUPI was only a one-time voucher. This voucher was launched in August last year. This voucher works on the unified payment interface platform of the national payment corporation of India. e-RUPI vouchers are largely being issued by the government for covid-19 vaccination. There are various other cases that are being actively considered by various State governments and Central governments. There are 16 banks that are issuing this voucher while 8 banks are acquirers of e-RUPI

DDA PM Uday Yojana

Key Highlights Of e-RUPI Digital Payment

| Name Of The Article | e-RUPI Digital Payment |

| Launched By | Government Of India |

| Beneficiary | Citizens Of India |

| Objective | To Provide Cashless And Contactless Instrument For Making Digital Payments |

| Official Website | https://www.npci.org.in/ |

| Year | 2022 |

Uses Of e-RUPI Digital Payment Platform

With the help of the e-RUPI platform, the payment of the service provider will be made only after the completion of a transaction. This payment platform will be prepaid in nature which does not require any kind of intermediary to make payment of the service provider. Other than that this platform can also be used for delivering services under schemes that are meant for providing drugs and nutritional support like mother and child welfare scheme, TB eradication program, drug and diagnostic under a scheme like Ayushmann Bharat Pradhan Mantri Jan Arogya Yojana, fertilizer subsidies, etc. The private sector can also leverage these digital vouchers for their employee welfare and corporate social responsibility programs. Leak-proof revolutionary delivery of welfare services will be ensured through this initiative.

Voucher Issuing Procedure

The e-RUPI digital payment system has been developed by the National Payment Corporation of India on its UPI platform. The national payment corporation of India has boarded banks that will be the issuing authority of the voucher. The corporate or government agency is required to approach the partner bank (private and public sector lenders) along with the details of the specific person and purpose for which the payment is required to be made. The identification of beneficiaries will be done by using their mobile number voucher allocated by the bank. This platform will be our revolutionary digital initiative which will improve the standard of living and make the procedure of payment simple.

Jan Dhan Account Kaise Khole

PM @narendramodi to launch #eRUPI today at 4:30 pm

Here’s everything you need to know about e-RUPI

Watch on PIB’s

YouTube: https://t.co/fC4K3Q10TJ@PMOIndia@UPI_NPCI pic.twitter.com/aB6HioZSg9— PIB India (@PIB_India) August 2, 2021

About National Payment Corporation Of India

National Payment Corporation of India is an organization that is responsible for operating retail payments and settlement systems in India. This organization has been started by the Reserve Bank of India and the Indian banks’ association. This organization works under the provision of payment and settlement systems act 2017 in order to create robust payment and settlement infrastructure in India. National Payment Corporation of India is a non-profit organization that works under the provision of section 8 of the companies act 2013. NPCI is also responsible for maintaining the infrastructure for the banking system in India for physical and electronic payment and settlement systems through the use of technology.

This organization focuses on bringing innovation to the payment system by introducing of technology. The promoter banks of NPCI are State bank of India, Punjab national bank, Bank of Baroda, Canara Bank, Union Bank of India, Bank of India, ICICI bank, HDFC bank, Citibank, and HSBC.

Launching Of e-RUPI Digital Payment Platform

The e-RUPI digital platform was launched on 2nd August 2021 through video conferencing. In this video conferencing Prime Minister Mr. Narendra Modi has launched e-RUPI. On the occasion of launching this payment platform, the chief executive chairman of the National health authority has also provided highlights of this platform along with the Prime Minister. The first time use of E-RUPI digital payment has been shown in a private vaccination center of Mumbai on the occasion of launching this platform.

Objective Of e-RUPI Digital Payment

The main objective of the e-RUPI digital payment platform is to provide a cashless and contactless payment system so that citizens can make digital payments without any kind of difficulty. With the help of this payment platform, users can make payments in a secure manner. This payment platform uses a QR code or SMS string-based e-voucher which will be delivered to the mobile of the beneficiary. e-RUPI digital payment platform ensures the timely payment of the services without the involvement of an intermediary. Users are not required to carry any cards or digital payment app or have internet banking access in order to make payments which will make the payment process simple and secure

List Of Banks That Are Live With e-RUPI

| Name of Banks | Issuer | Acquirer | Acquiring App |

| Union Bank of India | Yes | No | NA |

| State bank of India | Yes | Yes | YONO SBI Merchant |

| Punjab national bank | Yes | Yes | PNB Merchant Pay |

| Kotak bank | Yes | No | NA |

| Indian bank | Yes | No | NA |

| Indusind bank | Yes | No | NA |

| ICICI bank | Yes | Yes | Bharat Pe and PineLabs |

| HDFC bank | Yes | Yes | HDFC Business App |

| Canara bank | Yes | No | NA |

| Bank of Baroda | Yes | Yes | BHIM Baroda Merchant Pay |

| Axis bank | Yes | Yes | Bharat Pe |

Features Of e-RUPI Digital Payment

- The honourable Prime Minister of India Mr Narendra Modi is going to launch a digital payment platform called e-RUPI digital platform on 2 August 2021

- This platform will be cashless and contactless instrument

- Through this system users can make digital payments through QR code or SMS string based e-voucher

- This voucher will deliver to the mobile of the users

- Users can redeem this voucher without any payment app, internet banking or card

- The national payment Corporation of India has developed e Rupi Digital Payment service on its UPI platform.

- The collaborating partners are the Department of financial services, Ministry of health and family welfare and national health authority

- Through this initiative the sponsor of services will be connected with the beneficiaries and service providers. This connection will be held in a digital manner without any kind of physical interface

- Through this platform the payment to the service provider will be made after the completion of transaction

- This payment platform is prepaid in nature

- e-RUPI does not require any kind of service provider to make payment

- This platform can also be used for providing services under schemes which are meant for providing drugs and nutritional support.

Benefits Of e-RUPI

| Benefits for Consumers | Payment processes is contactlessOnly have to follow a two-step redemption process need to have any kind of digital payment app or bank account consumer is not required to share his or her personal details In order to maintain privacy |

| Benefits for Hospitals | The voucher is prepaid hence the payment process is completely secure voucher can be redeemed in few steps hospitals are not required to handle cash hence hassle-free and contactless payments can be ensured voucher is authorized through a verification code which makes the payment process easy and secure |

| Benefits for Corporates | The well-being of employees can be enabled by the corporate voucher distribution quick, safe, and contactless issuer can track the voucher redemption leads to cost reduction because the transactions are digital and don’t require any physical issuance |

Other Services Provided By NPCI

National Payment Corporation of India is responsible for operating retail payment and settlement systems in India. The national payment corporation is offering the following type of services to the citizen of India:-

Unified payment interface (UPI)

Through this feature, the multiple bank accounts of a person can merge into a single mobile application.

Rupee and Payment (RuPay)

It is a domestic card payment network of India that accept at ATMs, POS devices, and e-commerce websites throughout the country. It is a secure network that protects the users against anti-phishing

Bharat Interface For Money (BHIM)

BHIM is an app through which you can make simple, easy, and quick payments and transactions by using your unified payment interface. Instant bank to bank payments can make through BHIM and the user can also collect money using just a mobile number or virtual payment address

National Automated Clearing House (NACH)

Through NACH interbank high-volume electronic transactions which are repetitive and periodic in nature are facilitated. This platform is used by banks, financial institutions, corporate and the government

Immediate Payment Service (IMPS)

Through IMPS 24×7 interbank electronic fund transfer ensure through multiple channels like mobile, internet, ATM, SMS, etc. It is a robust and real-time fund transfer system that transfers the fund instantly within banks across the country. IMPS is totally safe and economical.

National Electronic Toll Collection (NETC)

in order to meet the electronic tolling requirement of the Indian market, the National Payment Corporation of India has developed a national electronic toll collection. Through this platform nationwide toll payment solution offer which includes clearing house service for settlement and dispute management

BHIM Aadhaar

through BHIM Aadhaar merchants are unable to receive digital payments from the customers. This platform works through Aadhaar authentication. Through this platform, merchants accept payment from customers of banks by authenticating their biometrics

Adhaar Enabled Payment System(AePS)

AePS Is the online interoperable financial inclusion transaction that is done at POS through the business correspondent of the bank by using Aadhaar authentication. You can do six types of transactions through this platform. Customers require to input only bank name, Aadhaar number, and fingerprint captured during enrolment in order to make payment

National Financial Switch(NFS)

It is a network that has 37 members and connects 50,000 ATMs. This platform establishes strong and sustainable operational models having in-house capabilities. The operational functions and services in national financials switch are at par with other global ATM networks.

Cheque Truncation System(CTS)

It is a process of clearing cheques electronically rather than processing the cheque physically. This process takes place by presenting a bank en-route to the paying bank branch. National Payment Corporation of India is responsible for Managing this platform. This system is also going to save a lot of time.

Highlights Provided By The Chief Executive Chairman Of National Health Authority

The chief executive chairman of the National health authority has appreciated the e-RUPI initiative launched under the Digital India mission. He has highlighted the fact that this payment platform is as important as BHIM UPI. This platform is a person and purpose-specific instrument which is based on the architecture of UPI. He has also highlighted the purpose-specific nature of this instrument. As of now the government or other institutions are not required to give money for various types of benefits. In place of money, they can issue this voucher and the beneficiary can be able to only use this voucher for the purpose it has been issued.

- This platform is real-time and paperless. Health, nutrition, education, etc departments will be able to take advantage of this platform. Along with that, it can be used for the national Digital Swasthya mission. This voucher is recognized by the Reserve Bank of India.

- Through this platform, direct fund transfers can be made to the service provider. This voucher can use only one time.

Highlights Provided By Honorable Prime Minister Narendra Modi

- On the occasion of launching the e-RUPI platform, the honorable prime Minister of India has highlighted various benefits of this platform.

- He has highlighted the fact that this initiative is a step towards digital governance.

- With the help of this platform digital transactions can be made easily and this platform will play a major role in making digital payments effective.

- This voucher will help in making transactions in a targeted, transparent, and leakage-free manner.

- The Prime Minister has also highlighted the fact that India is moving ahead with the help of digital technology.

- The standard of living of citizens is improving and technology is playing a major role in the lives of citizens of India.

- He has also expressed his gratitude that this initiative is being launched when the nation is celebrating Amrit Mahotsav on its 75th independence day.

- This voucher can not only be used by the government but NGOs can also provide this voucher in place of cash if they want to help someone in education, health, etc.

- This initiative will ensure that money provided to beneficiaries is used for the same purpose.

- In the initial phase of this scheme, only health sector benefits will cover.

- The prime Minister has given various examples of using this voucher like in vaccination drives, old age homes, for hospitals etc.

- This voucher is person and purpose specific.

- Only the person for whom this voucher has issued can use it.

- He has also highlighted the importance of technology.

- The banks and payment gateways have played a major role in launching this platform.

- Many private hospitals, corporates, businesses, NGOs and other institutions have shown their interest in e-RUPI platform.

View List Of Live Hospitals On e-RUPI

- First of all go to the official website of national payment Corporation of India

- The home page will open before you

- On the homepage click on what we do Option

- Now you have to click on UPI

- After that, you have to click on e-RUPI live partners

- After that you have to click on Live Hospitals on e-RUPI

- A PDF file will appear before you

- In this PDF file you can view list of live hospitals on e-RUPI.

Download e-RUPI Digital Payment Mobile App

- First of all open Google play store or Apple App Store in your mobile phone

- Now in the search box you have to enter e-RUPI Digital payment

- After that you have to click on search

- A list of apps will display before you

- You have to click on the first option

- After that, you have to click on install

- e-RUPI digital payment mobile app will download to your device

Procedure To Redeem e-RUPI Voucher

- The beneficiary has to show the e-RUPI QR code or SMS at the service provider outlet

- The salesperson requires to scan this QR code or SMS

- Now an OTP will receive through the beneficiary

- The beneficiary has to share this OTP with the service provider

- The service provider has to enter this OTP into the OTP box

- Now service provider has to click on proceed

- Payment will make to the service provider

Contact The Department

- Visit the official website of the national payments Corporation of India

- The homepage will open before you

- On the homepage click on get in touch Option

- Now a new page will appear before you

- On this new page you have to enter the following details:-

- Name

- Email ID

- Contact

- Subject

- Description

- Captcha code

- After that click on submit button

- By following this procedure you can contact the department

View Contact Details Of Offices Of NPCI

- Go to the official website of the National Payments Corporation of India

- The homepage will open before you

- Now you have to click on the get in touch option.

- A new page will open before you

- You have to scroll down

- At the bottom of the page, you can view the details of the offices of NPCI

Helpline Number

Through this article, we have provided you with all the important details regarding e-RUPI digital payment. If you are still facing any kind of problem then you can contact the department through its helpline number in order to solve your problem. The helpline number is 18001201740.