IGR Odisha Registration, Apply for Encumbrance Certificate, Land Valuation | IGR Odisha Application Status & Stamp Duty @ igrodisha.gov.in

Through the online IGR portal, it is now simple to register your property in Odisha. To facilitate smooth communication among citizens, the organization promotes collective decision-making. It can be done on the IGR Odisha website through the Inspector General of Registration (Odisha) Revenue and Disaster Management Department. The public entity offers a user-friendly registration service that aids in upholding and defending the interests of the government of Odisha and its citizens. Read below to get detailed information related to the IGR Odisha like highlights, objectives, features, services offered, documents required, calculation Stamp duty and Registration charges, and much more

Table of Contents

IGR Odisha 2022-23

The inspector general of registration (IGR) of the government of Odisha assists citizens with the registration of property documents and also raises money by charging a stamp duty. IGR Odisha has launched a website in keeping with its objective to leverage digital technologies to deliver services to users in a timely and transparent manner.

Krushak Odisha Portal

IGR Odisha Highlights

| Portal Name | IGR Odisha |

| Initiated by | Inspector General of Registrations (IGR), Odisha |

| Managed by | Revenue & Disaster Management Department. |

| State | Odisha |

| Beneficiaries | Odisha Residents |

| Official Website | https://www.igrodisha.gov.in/ |

IGR Odisha Objectives

The objectives of IGR Odisha are as follows:

- The following are the few tasks that this public authority manages and completes:

- Issuing guidelines or directives that will be followed to carry out the terms of the Indian Stamp Act or Indian Registration Act.

- Along with safeguarding the government’s interests, it is done to facilitate improved services for the broader population.

- Society registered under the S. R. Act of 1860

- Creation of everything needed for Orissa’s registration offices

Safal Odisha Portal

IGR Odisha Features

Some of the key features of IGR Orissa are as follows:

- Updating land records and digitizing cadastral maps

- The connection between revenue offices

- Using current technology to conduct survey activities

- The automation of tax offices

- Acquiring private property for public use

- Alienation of tribal land is prohibited

- Distribution of extra land at the ceiling

- Management of minor minerals

- Implementation of the annual census

- Distributing wasteland for residential use

- Regularization of forest villages built before 1980 and encroaching human settlements, etc.

- Creation of comprehensive relocation and rehabilitation plans for displaced people

Services Offered by the IGR Odisha Portal

IGR Odisha provides an online application platform for submitting requests for encumbrance certifications, property registrations, the computation of stamp duty, and the payment of stamp duty. Additionally, it provides access to information about the relevant SRO as well as a facility for an online certified copy. The computerization of revenue offices, the digitization of land records, and land survey operations using cutting-edge technology are only a few of the crucial activities carried out by the revenue department. In addition to encroaching on private property, IGR Odisha offered to regularize forest communities, distribute wastelands for agricultural use, and distribute wastelands.

E District Odisha

Documents Needed to Register Under IGR Orissa

The list of required documents for the Inspector General of Registration in Odisha is as follows:

- All the records demonstrating who the rightful owner of the property being traded

- For all the executors, identifiers, and claimants, proof of identity like an aadhaar card, driving license, PAN card, passport, or EPIC

- Passport-sized photos of each of the claimants, identifiers, and executors

- They must file Form No. 60 under the Income Tax Act if they are unable to furnish a copy of their PAN card

- Executors and claimants must provide a photocopy of the PAN card if the document has a value of more than ten lakh rupees

- Power of Attorney registration combined with the attorney’s picture identity verification document should both be registered if the attorney is the document’s holder.

- Submission of the encumbrance certificate, as well as the ROR, published to date

- If the property being transferred has no buildings or structures, a prescribed format declaration properly signed by the transferor and the transferee is required.

- If there is a building or other structure on the land, a legally binding declaration in the required form, is signed by both the transferor and the transferee.

- When an SC or ST person transfers the property to a non-SC or ST person, the necessary permission from the revenue officer is required

- Issuance of a NOC or the necessary authorization by the Endowment’s Competent Authority for the transfer of the deity’s property

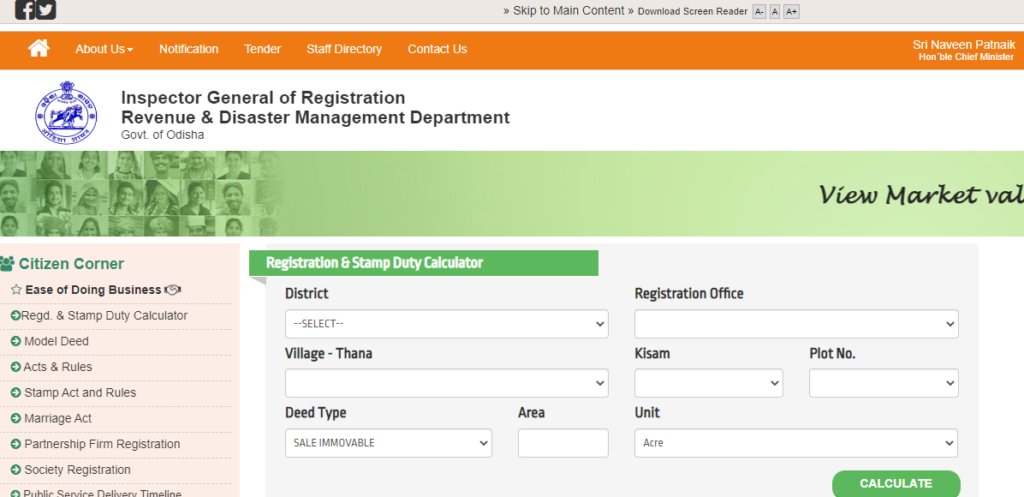

Procedure to Calculate Stamp Duty and Registration Charges on IGR Odisha Portal

To calculate Stamp duty and Registration charges on IGR Odisha Portal, applicants need to follow the below-given steps:

- First of all, go to the official website of IGR Odisha, i.e. https://www.igrodisha.gov.in/

- The homepage of the website will open on the screen

- Under the Ease of Doing Business tab, click on the Regd & Stamp Duty Calculator option

- A new page will open on the screen\

- Now, enter all the required details like in the district, registration office, village-thana, kisan, plot no, area, Deed type, and unit

- After that, click on the calculate button to calculate Stamp duty and Registration charges

Procedure to Calculate Stamp Duty Charges on IGR Odisha portal

Applicants need to follow the below-given steps to calculate the stamp duty charges on IGR Odisha Portal:

- First of all, visit the official website of IGR Odisha, i.e. https://www.igrodisha.gov.in/

- The homepage of the website will open on your screen

- Click on the Regd and Stamp Duty Calculator option

- The Registration & Stamp Duty Calculator page will open on the screen

- Now, fill in all the required details like District, Registration Office, Plot No., Village – Thana, Area, Deed Type, Unit

- Finally, click on the Calculate button to calculate the stamp duty charges

Different Deed Formats for IGR Orissa

You can check the various deed forms on the IGR Orissa website in the following ways:

- Formats of Sales deeds in both Odia and English

- Format for House rent agreement

- Format of Lease deed

- Format for Gift deed

Format for Mortgage Deed

Time Frames and Levels for IGR Orissa Decision-Making Process

| S. No. | Activity | Level of Action | Time |

| 1 | Receipts of correspondence/letters/DAKs | Diarist | On the same day |

| 2 | Diarization of DAKs/Correspondence and distributing it to the Dealing Asst. | Diarist | Up to 2 to 3 days |

| 3 | Placed in front of the authority for perusal | Relevant concerned authority | On the same day |

| 4 | Receiving letters marking | Section officer | On the same day |

| 5 | The branch office begins the decision-making process within their competency | Under the secretary Jt. IGR | Up to 5 to 7 days |

| 6 | New files opening Putting the old related files | Dealing Asst. | Up to 3 to 7 days |

| 7 | Stimulating examination and comments | Section officer | Up to 2 to 5 days |

| 8 | Final Disposal | IGR Orissa | No fixed timeline |

User Charges for E-Registration

| S. No. | Type Of Deed | Charges for e-registration services |

| 1 | Movable Gift | ₹ 200. The movable gift to the government is exempted from paying any amount. |

| 2 | Movable Sale | From ₹ 100 to ₹ 200 |

| 3 | Conveyance | From ₹ 100 to ₹ 200 |

| 4 | Adoption | ₹ 200 |

| 5 | Immovable Gift | ₹ 200. The immovable gift to the government is exempted from paying any amount. |

| 6 | Immovable Sale | From ₹ 100 to ₹ 200 |

| 7 | Partnership | From ₹ 50 to ₹ 200 |

| 8 | Movable Partition | ₹ 200 |

| 9 | Reserved Less Rent | Between ₹ 100 to ₹ 200 |

| 10 | Lease with Advance only | ₹ 200 |

| 11 | Lease with Advance as well as Rent | Between ₹ 100 to ₹ 200 |

| 12 | Power of Attorney | ₹ 200 |

| 13 | Immovable Partition | ₹ 200 |

| 14 | Trust | ₹ 200 |

| 15 | Will | From ₹ 50 to ₹ 200 |

| 16 | Exchange | ₹ 200 |

| 17 | Agreement | ₹ 100, ₹ 200 and ₹ 500 |

| 18 | Affidavit | ₹ 50 |

| 19 | Divorce | ₹ 200 |

| 20 | Bond | ₹ 50 and ₹ 200 |

| 21 | Release | ₹ 100 and ₹ 200 |

| 22 | Settlement | ₹ 100 and ₹ 200 |

| 23 | Mortgage | From ₹ 100 to ₹ 200. Mortgage to the government is exempted from paying any fees. |

| 24 | Duplicate or Counterpart | ₹ 200 |

| 25 | For any other miscellaneous document | ₹ 150 |

Contact Us

For any other query related to the IGR Odisha Portal, feel free to contact us at the below-given details:

Address: Inspector General of Registration Odisha,2nd-floor, Board of Revenue Building, Chandni Chowk, Cuttack (Odisha)-753002

Helpline Numbers: (+91)7894438202, (+91)7894438220.

Email Id: [email protected]