MSME Registration Certificate Download, Fee, Benefits, How to Do MSME Registration Online 2023, Application Form at udyamregistration.gov.in

MSME (Micro, Small, and Medium Enterprises) refers to any business with a revenue of less than 120,00,00,000. Analysts believe that these are the foundations of any country’s economy. This aids the market in ensuring that wealth is distributed fairly. As a result, the Indian government provides MSMEs with several subsidies, incentives, and other benefits. The MSMED (Micro, Small, and Medium Enterprises Development) Act accomplishes this. To take advantage of these perks, a company must first register with them. Here we are providing you with the details for MSME Registration Online and also other related details with the Udyog Aadhar Registration

About Micro, Small, and Medium Businesses?

MSME is a government initiative aimed primarily at delivering benefits to medium and small-scale entrepreneurs in order to help them grow their enterprises in today’s highly competitive environment. The MSME scheme gives loans to budding entrepreneurs, aiding them in establishing their firms by alleviating their financial difficulties.

Previously, MSME classification was based on factors such as plant and machinery or equipment investment. As a result, in order to benefit from MSME benefits, MSMEs must limit their investment to a lower level, as detailed below:

| Existing MSME Classification | ||||

| Sector | Criteria | Micro | Small | Medium |

| Manufacturing | Investment | < Rs.25 lakh | < Rs.5 crore | < Rs.10 crore |

| Services | Investment | < Rs.10 lakh | < Rs.2 crore | < Rs.5 crore |

Because they couldn’t extend their company any further, these lower restrictions were destroying their will to expand. The government has changed the MSME classification under the Aatmanirbhar Bharat Abhiyan (ABA) by incorporating composite criteria for both investment and annual turnover.

In addition, there has been a long-standing demand for the MSME categorization to be revised so that they may grow their activities while still receiving MSME benefits. In addition, the MSME definition no longer distinguishes between the manufacturing and service industries.

The following is the most recent MSME categorization, which takes into account investment and yearly revenue when determining an MSME.

| Revised MSME Classification | |||

| Criteria | Micro | Small | Medium* |

| Investment & Annual Turnover | < Rs.1 crore &< Rs.5 crore | < Rs.10 crore &< Rs.50 crore | < Rs.50 crore &< Rs.250 crore |

Previously, MSME Registration only applied to manufacturing and service industries. However, the government declared in July 2021 that wholesale and retail trade will fall within the MSME categorization and that wholesale and retail trade businesses can apply for MSME Registration, with the exception of motor vehicles and motorcycles. As a result, manufacturing and service industries, as well as wholesale and retail trade, are all covered and eligible for MSME Registration.

e Gram Swaraj Portal

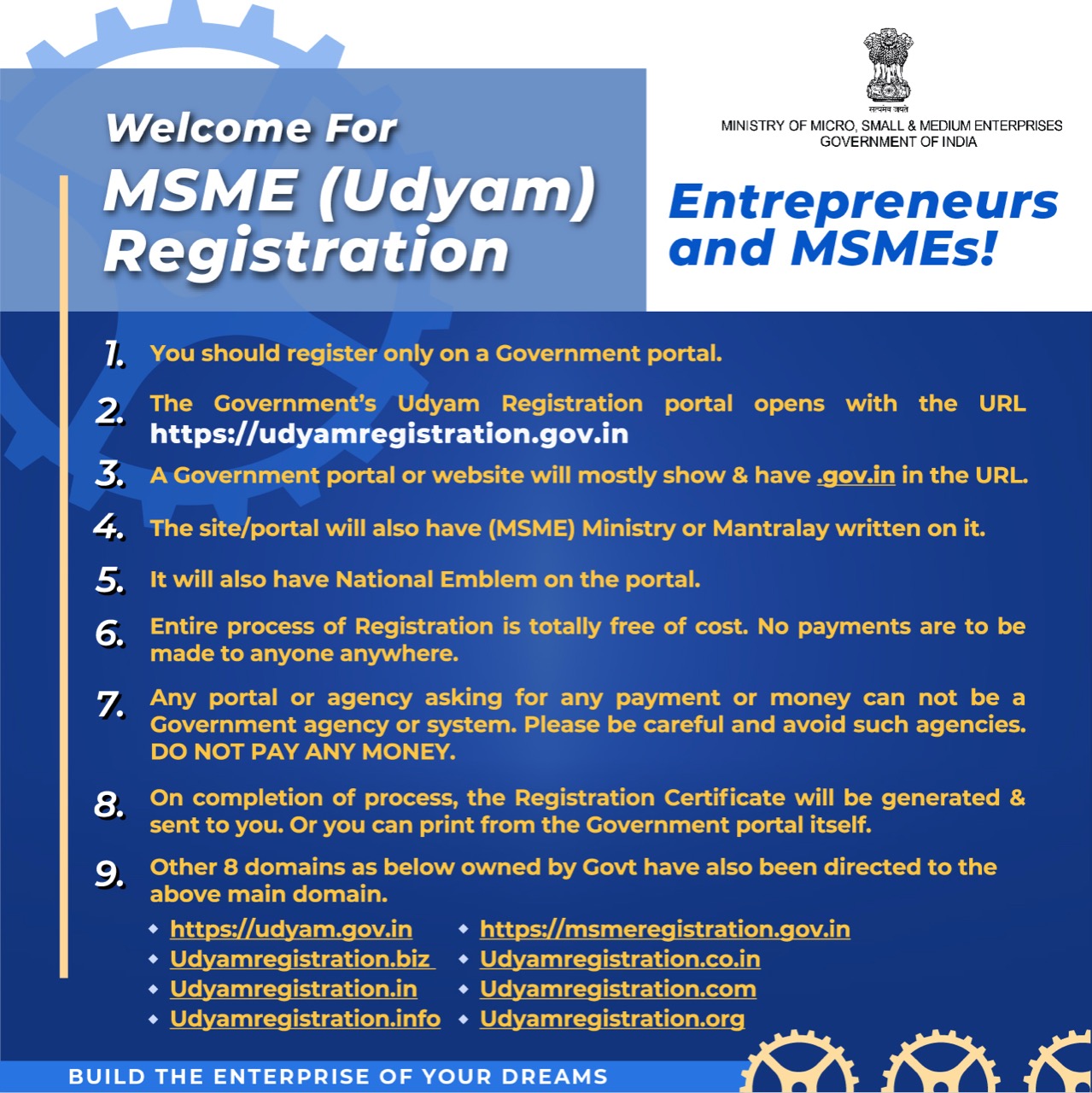

MSME Online Registration Process on Udyam

MSME Registration is entirely done through online mode. The registration can be done through udyamregistration.gov.in, the government portal. MSMEs can be registered in the portal under the following two categories:

- For New Entrepreneurs who are not Registered yet as MSMEs or those with EM-II and.

- For those having registration as UAM and for those already having registration as UAM through Assisted filing.

MSME Registration For New Entrepreneurs who are not yet MSME-Registered or who have EM-II

“For New Entrepreneurs who are not yet Registered as MSME or those with EM-II” need to be clicked to register for MSME by New entrepreneurs and entrepreneurs having EM-II registration. The Aadhaar card number and the PAN number are required for the new MSME Registration.

When the “For New Entrepreneurs who are not yet Registered as MSME or those with EM-II” button on the government portal’s homepage is clicked, a registration page appears, asking for the entrepreneur’s Aadhaar number and name. After providing these details, click the “Validate and Generate OTP Button.” The PAN Verification page appears after this button is clicked and an OTP is received and submitted.

The entrepreneur must then click the “Validate PAN” button after entering the “Type of Organization” and the PAN Number. The portal obtains PAN information from government databases and verifies the entrepreneur’s PAN number.

The Udyam Registration form will appear after the PAN has been verified, and the entrepreneurs must fill in their personal information as well as the details of their business.

After filling out the details on the MSME registration form, click the “Submit and Get Final OTP” button. The MSME online registration procedure will be completed, and you will receive a notice stating that your registration was successful, along with a reference number. Make a note of the reference number for future reference. The Udyam Registration Certificate is issued when the MSME registration form is verified, which may take a few days.

PM Mudra Loan

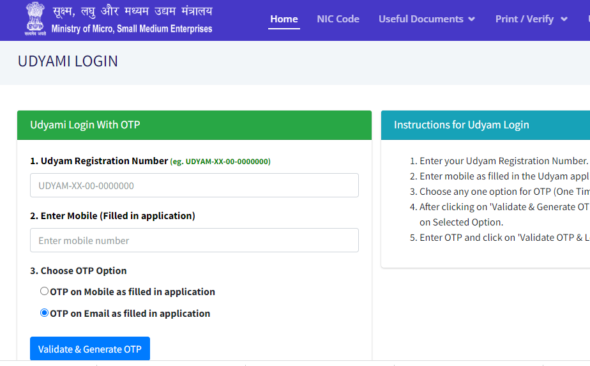

MSME Registration For Entrepreneurs Already Having UAM

Those who have already registered as UAM must click the “For those who have previously registered as UAM” or “For those who have already registered as UAM through Assisted filing” buttons on the government portal’s home page. This will take you to a screen where you can enter your Udyog Aadhaar number and choose an OTP option.

The alternatives are to get an OTP on your phone as a filled-in UAM or to get an OTP through email as a filled-in UAM. After selecting the OTP options, click “Validate and Generate OTP.” After entering the OTP, fill out the MSME registration form with your information, and your Udyam registration will be complete.

MSME Registration Application Form Details

On the MSME application form, the entrepreneurs must put up the following information:

- Aadhar number

- Name of entrepreneur as per Aadhar card

- Type of organization (Proprietorship, limited liability partnership, partnership firm, private or public limited company, co-operative society, Hindu undivided family, self-help group, society or trust)

- Gender

- Name of Enterprise

- Location of plant/unit

- PAN card

- Social category (General, OBC, SC/ST)

- Business activity of an enterprise

- NIC code of the primary activity

- Number of employees Office address of the enterprise

- Date of commencement of business or incorporation or registration of enterprise

- Bank account number and IFSC code

- Investment amount in plant and machinery (if there is no investment in plant and machinery, entrepreneurs can write it as zero)

- Turnover (if there is no turnover, entrepreneurs can write it as zero)

Documents Needed for MSME Registration

The only papers required for MSME registration are an Aadhaar Card and a PAN Card. MSME registration can be completed entirely online, with no verification of documentation required. The Udyam Registration Portal would automatically pull PAN and GST-linked information on investment and turnover from government databases. The Income Tax and GSTIN systems are fully connected with the Udyam Registration Portal.GST is optional for businesses that are not required to register under the GST statute. However, businesses that are required to obtain GST registration under the GST regime must first obtain GST registration before applying for Udyam Registration.

Those who hold a UAM registration or any other registration issued by the Ministry of MSME will need to re-register at the Udyam Registration Portal by selecting “For New Entrepreneurs who are not yet Registered as MSME or those with EM-II.”

Enterprises with UAM registration must switch to Udyam Registration by December 31, 2021. If entrepreneurs with UAM registration do not migrate to Udyam Registration by December 31, 2021, their UAM registration will become invalid, and they will no longer be eligible for MSMEs incentives.

Credit Guarantee Scheme for Startups

MSME Registration Fees

Enterprises with UAM registration must switch to Udyam Registration by March 31, 2022. If entrepreneurs with UAM registration do not migrate to Udyam Registration by March 31, 2022, their UAM registration will become invalid, and they will no longer be eligible for MSMEs incentives. To receive MSME benefits, they will need to re-register for Udyam registration.

MSME Registration Certificate

A notice of successful registration with a reference number will display after submitting the MSME registration form online. After verifying the registration form completed on the portal, the Ministry of MSME will send the Udyam Registration certificate or MSME certificate to the entrepreneur’s email address.

After a few days have passed after the registration form was submitted, the Ministry will provide the MSME certificate. The MSME registration certificate is valid for the rest of your life. As a result, it does not need to be renewed.

How to Obtain an MSME Registration Certificate Online?

To obtain an MSME certificate online, an entrepreneur must go to the Udyam Registration portal and download the MSME certificate. The following is the procedure for obtaining an MSME registration certificate via the internet:

- Entrepreneurs must go to the ‘Print/Verify’ button on the portal’s homepage and select the ‘Print Udyam Certificate‘ option.

- The entrepreneurs must then enter their Udyam Registration Number, mobile number, select the OTP option, and click the ‘Validate and Generate OTP’ button on the following page.

- Click the ‘Validate OTP and Print’ option after entering the OTP sent to your phone number or email address.

- The MSME registration certificate will show on the screen, and you can print it directly from the page. After submitting the MSME registration form, an entrepreneur can check the MSME registration number using the reference number provided.

An entrepreneur can obtain the MSME Registration number by selecting the ‘Verify Udyam Registration Number’ option from the ‘Print/Verify’ tab on the homepage. The entrepreneurs must input the reference number, captcha code, and click the ‘Verify’ button on a new page. The MSME’s information, as well as the MSME registration number, will be displayed on the screen.

ESIC Online Payment

The Advantages of MSME Registration

- Bank loans become cheaper as a result of MSME registration because the interest rate is relatively low, around 1 to 1.5 percent. Interest rates are far lower than those charged on traditional loans.

- It also permitted minimum alternative tax (MAT) credits to be carried forward for up to 15 years rather than the previous 10 years.

- Once registered, the cost of obtaining a patent or establishing an industry is reduced due to the numerous discounts and concessions available.

- Because the Udyam Registration Portal is integrated with the Government e-Marketplace and numerous other State Government websites that provide easy access to their marketplaces and e-tenders, MSME registration makes it easier to get government tenders.

- For unpaid MSME payments, there is a One-Time Settlement Fee.

- The Udyam Registration will assist MSMEs in taking advantage of government initiatives such as the Credit Guarantee Scheme, Credit Linked Capital Subsidy Scheme, Public Procurement Policy, and Payment Delay Protection, among others.

- Banks are willing to lend to MSMEs for priority sector.

- MSMEs are eligible for a government security deposit waiver, which is beneficial when competing in e-tenders.

- In a single Registration, any number of activities, including service, manufacturing, or both, can be added or described.

- Subsidy for barcode registration.

- Scheme to exclude people from paying direct taxes.

- Reimbursement of ISO certification fees

- Electricity bills are reduced.

- In international trade exhibitions, special consideration is given.

MSME Schemes Launched by the Government

- Prime Minister Employment Generation Programme and Other Credit Support Schemes –

- Prime Minister Employment Generation Programme(PMEGP)

- Credit Guarantee Trust Fund for Micro & Small Enterprises (CGTMSE)

- Interest Subsidy Eligibility Certificate (ISEC)

- Development of Khadi, Village and Coir Industries –

- Science and Technology Scheme

- Market Promotion & Development Scheme (MPDA)

- Revamped Scheme Of Fund for Regeneration Of Traditional Industries (SFURTI)

- Coir Vikas Yojana (CVY)

- Technology Upgradation and Quality Certification –

- Financial Support to MSMEs in ZED Certification Scheme

- A Scheme for Promoting Innovation, Rural Industry & Entrepreneurship (ASPIRE)

- National Manufacturing Competitiveness Programme (NMCP):

- Credit Linked Capital Subsidy for Technology Upgradation

- Marketing Support/Assistance to MSMEs (Bar Code)

- Lean Manufacturing Competitiveness for MSMEs

- Design Clinic for Design Expertise to MSMEs

- Technology and Quality Upgradation Support to MSMEs

- Entrepreneurial and Managerial Development of SMEs through Incubators

- Enabling Manufacturing Sector to be Competitive through QMS&QTT

- Building Awareness on Intellectual Property Rights (IPR)

- Marketing Promotion Schemes –

- International Cooperation

- Marketing Assistance Scheme

- Procurement and Marketing Support Scheme (P&MS)

- Entrepreneurship and skill Development Programme –

- Entrepreneurship Skill Development Programme (ESDP)

- Assistance to Training Institutions (ATI)

- Micro & Small Enterprises Cluster Development (MSE-CDP)

- Scheme of Surveys, Studies and Policy Research

- National SC-ST-HUB

- Scheme of Information, Education and Communication

AIMS Portal

MSME’s Contact Number

The table below provides the helpline numbers for any queries.

| Helpline number for general queries related to MSME | 011-23063288 |

| Helpline number for Udyam Registration or Udyam Registration Certificate related for administration queries | 011-23063800 |

| Helpline number for Udyam Registration or Udyam Registration Certificate related for Technical queries | 011-23062354 |

| MSME contact address – Ministry of Micro, Small and Medium Enterprises, Udyog Bhawan, Rafi Marg, New Delhi | 110011. |

| MSME web information manager address – Ministry of Micro, Small and Medium Enterprises, Room No 468 C, Udyog Bhawan, Rafi Marg, New Delhi | 110011. E-mail: [email protected] |

FAQs

Yes, Udyog Aadhaar Registration has been replaced by Udyam Registration for MSME registration. If a micro, small, or medium-sized firm wants to start up, they can apply for MSME/Udyam registration. MSME/Udyam registration is entirely done online. This registration entitles the company to numerous privileges and incentives.

No. Businesses that fall into the MSME category are not required to apply for MSME registration. However, it is preferable to gain MSME/Udyam registration because the government offers a variety of incentives to MSME-registered businesses, including lending facilities, quick access to credit, low-interest rates, and eligibility for a variety of government programs.

Yes, both existing and new businesses can apply for MSME/Udyam registration, as long as the existing unit is operational and meets the registration requirements. To take advantage of the MSMEs’ incentives, businesses with a UAM registration must re-register for an Udyam registration.